Medical Alley’s startup community raised over $3 billion in capital in the public and private markets in 2021, cementing the region as one of the top health innovation ecosystems in the world. Past Medical Alley investment leader Bright Health Group went public in April, raising $924 million, one of four public offerings in the year. On the M&A front, digital health pioneer Provation was acquired by Fortive in a $1.425 billion deal, part of 60 such deals in 2021. In private capital, oncology device company Francis Medical led startup raises, and early-stage companies continued their ascent as the next wave of Medical Alley’s innovators.

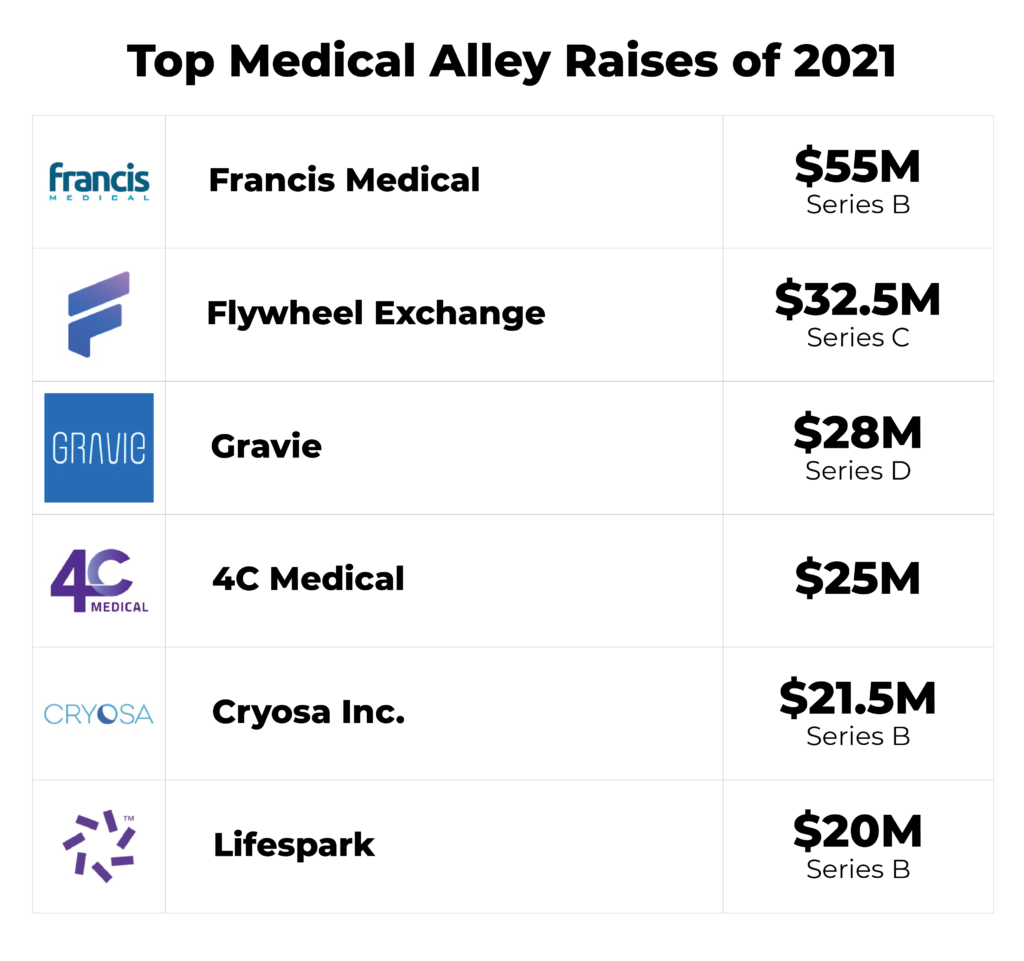

Funding for startups in the region totaled $437 million in 2021, led by Francis Medical, who raised $55 million in their Series B financing. Research data platform Flywheel raised a total of $32.5 million, payer Gravie followed with $28 million, and cardiac device innovator 4C Medical raised $25 million. Private investments reflected an increasingly common trend in the community: strength in biotechnology and pharmaceutical companies. Over $64 million was raised in the sector, a 64% increase from the $39.7 million raised in 2020.

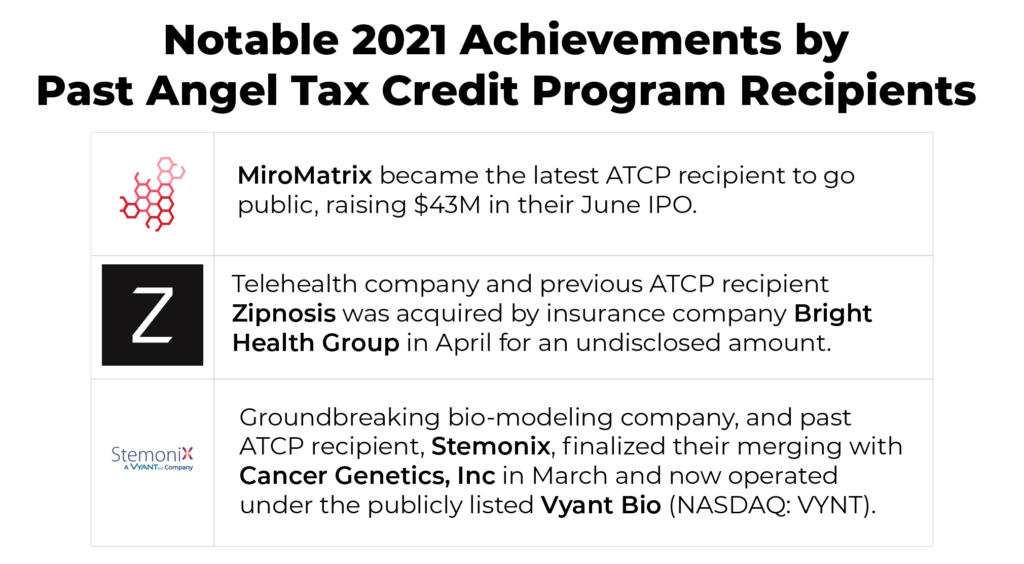

2021 was a breakout year for the next generation of health innovators, as 41 companies recorded investments of $1 million or less, nearly double that of the 2020 count (23). The wave of investment was aided by the Angel Tax Credit Program (ATCP), which provided $18.7 million to 30 healthcare startups during the year. Since its inception in 2012, the ATCP has assisted 179 healthcare companies in raising over $186 million of funding. These investments have greatly advanced innovation in the region, and in 2021, an ATCP alumni achieved a rare feat for users of the program: an IPO.

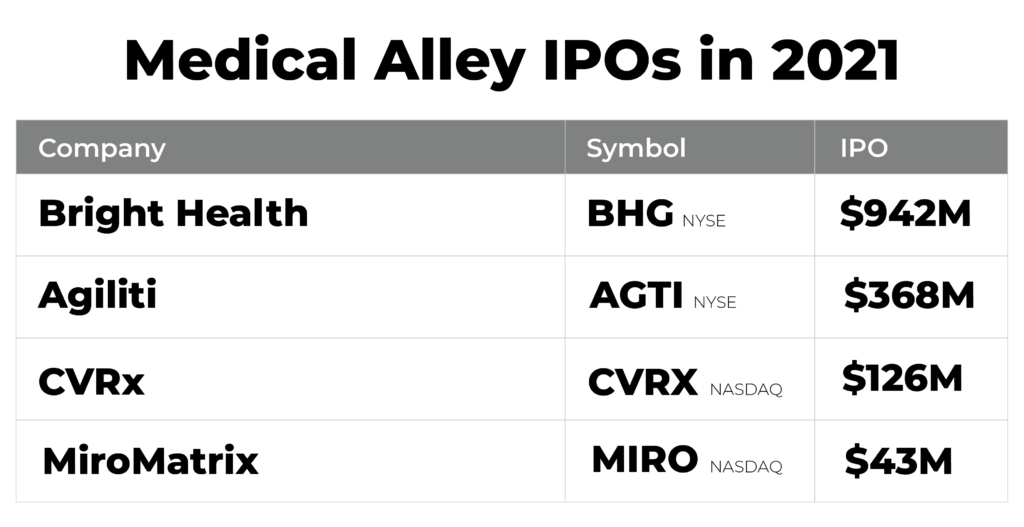

MiroMatrix, an early user of the ATCP, is working to end transplant waiting lists by developing bioengineered human organs. The company went public (NASDAQ: MIRO) in June, raising $43.2 million, and theirs was not the only IPO of a Medical Alley company. In addition to Bright Health Group’s $924 million IPO, Agiliti (NYSE: AGTI) raised $368 million, and CVRx (NASDAQ: CVRX) brought in $126 million. In total, almost $1.5 billion was raised in initial public offerings for Minnesota healthcare companies in 2021.

An additional $1.2 billion was raised by Medical Alley-based healthcare organizations in secondary public offerings and private placements, with notable successes by biotechnology and pharmaceutical companies. ANI Pharmaceuticals (NASDAQ: ANIP) raised $75 million through a public offering in November, just weeks after DiaMedica (NASDAQ: DMAC) received $30 million in a private placement. Earlier in the year, Celcuity (NASDAQ: CELC) recorded $24 million via public offering, expecting to use the funds to further research and development for new diagnostic and therapeutic options for cancer treatment. Outside of the biopharma sector, notable public transactions were medical device company Neovasc’s (NASDAQ: NVCN) raise of $72 million for the development of refractory angina and mitral valve disease treatments, and payer Bright Health Group’s announcement of plans to raise $750 million following their IPO.

Bright Health Group was also active as an acquirer. In April, they acquired Medical Alley-based, and ATCP recipient, digital health company Zipnosis. The acquisition was one of 60 deals worth at least $24 billion in Medical Alley. Major deals involving Medical Alley companies included Best Buy’s acquisition of Current Health (UK), Ecolab’s $3.7 billion acquisition of Purolite Life Sciences (Pennsylvania) in October, Optum’s $13 billion acquisition of Change Health (Tennessee) in December, and Medtronic’s $1.1 billion acquisition of Intersect ENT (California) in August. Medical Alley companies were also acquired throughout the year, with Smiths Medical, headquartered in Medical Alley and boasting a 500+ person workforce, announcing their acquisition by ICU Medical in August, with a close date in 2022. GeneMatters, a digital health genomics company, was acquired by Genome Medical in August, and Minneapolis-based Provation was acquired by Fortive for $1.425 billion in December. In total, 31 Minnesota healthcare organizations were acquired in 2021.

Medical Alley Association is actively investing resources to maintain and grow our momentum. Medical Alley Starts, an initiative to lower the cost of starting, scaling, and pivoting new ventures in the region through partnerships, public policy, and most importantly, directly supporting entrepreneurs, launched in February of 2021. In its first year, Medical Alley Starts worked with 250 companies and provided 1,500 services, including 310 supplier referrals, 230 peer-to-peer connections, 140 corporate development connections and over 170 investor introductions.

The 2021 successes within the region will continue into 2022, further cementing Medical Alley as the Global Epicenter of Health Innovation and Care®.