Bright Health, Bind Benefits account for half of venture capital invested nationally.

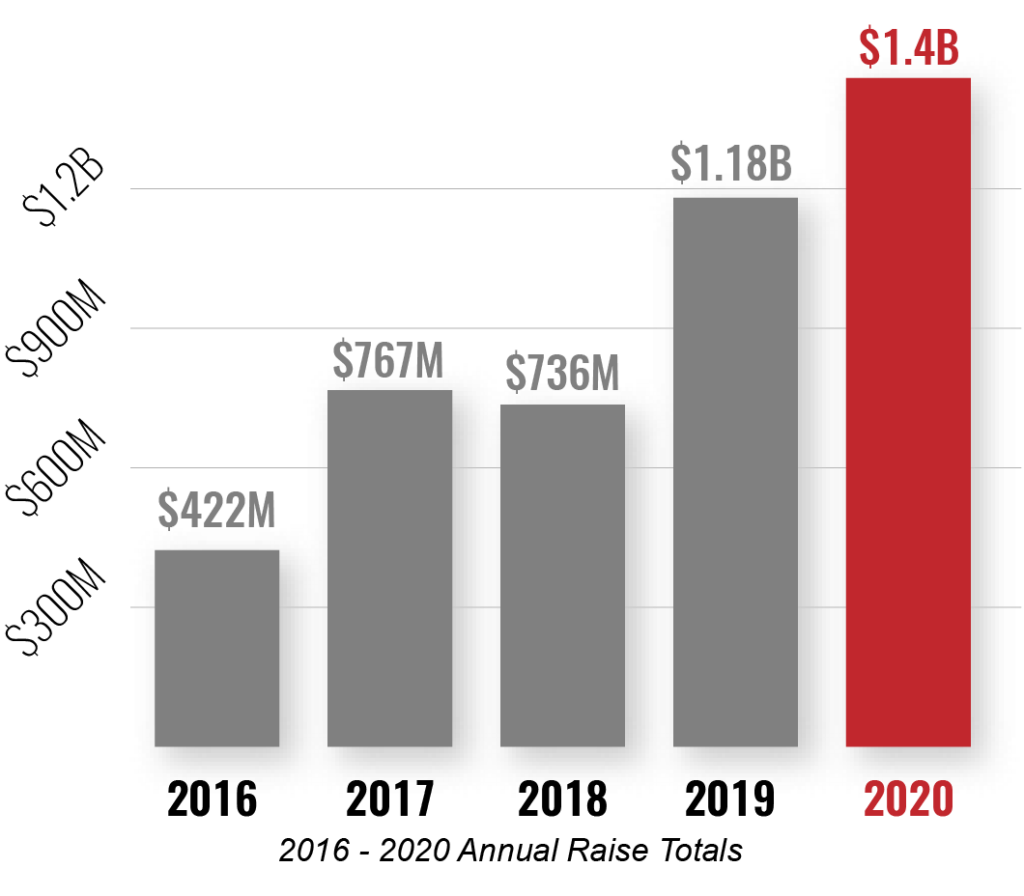

2020 was a record year for investment in Medical Alley startups. The region raised $1.4 billion, exceeding $1 billion by Q3, on the heels of breaking $1 billion in 2019. Health plan startups Bright Health and Bind Benefits, along with digital device company Preventice Solutions, led the crowded pack of transformative companies drawing capital to Medical Alley.

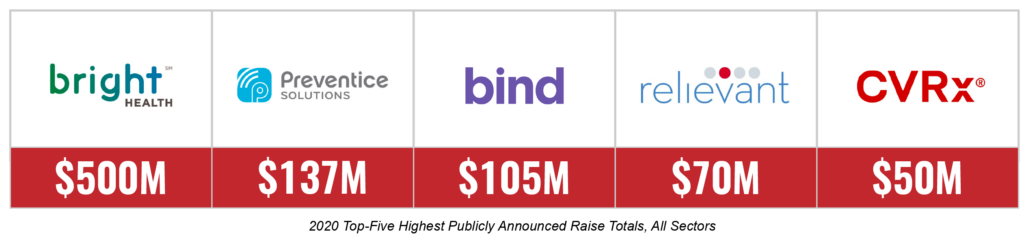

Bright Health and Bind Benefits, delivering innovative new payment models, drove Medical Alley’s billion-dollar year. Bright’s $500 million Series E raise was the 4th largest healthcare raise in the country and topped all Medical Alley companies. Bind Benefits’ $105 million Series B ranked as the third-highest raise among health plan startups in the nation and was the third-highest raise among all healthcare companies in Medical Alley. In 2020, these two companies accounted for half of all funds raised by U.S. health plan companies. Since 2016, the two companies’ combined $1.8 billion raised represents more than 40% of all investments in the space.

Medical Alley continues to be the driver of a shift to value-based care, innovative plan models and new partnerships. In 2020, Blue Cross and Blue Shield of Minnesota and Allina Health entered into a 6-year ground-breaking value-based agreement. Medical Alley is also home to the nation’s largest private health insurer, UnitedHealth Group and the Allina Health Aetna Joint Venture.

Medical Alley again demonstrated its leadership in the medical device sector. With the headquarters and significant presence of industry leaders like Medtronic, 3M, Boston Scientific, Abbott, Smiths Medical, Starkey, Colopast, and others, the region continues to deliver transformational innovation in this space. In another record setting year, the Medical Alley device industry raised over $507 million. The record was led by remote monitoring company Preventice Solutions’ $137 million series B, the second largest in Medical Alley for the year. Preventice was part of the record-breaking Q3, which saw Medical Alley companies raise $759 million. Preventice’s raise was followed by Relievant Medsystems ($70 million), CVRx Inc ($50 million) and HistoSonics ($40 million).

Medical Alley also delivered significant exits throughout 2020 and into this year. 2021 has already seen the recent acquisition of Preventice Solutions by Boston Scientific, with a value of $925 million up front and milestone payments that could exceed $1.2 billion. Twelve Medical Alley companies were acquired in 2020, some of whom have appeared in our previous investment reports. In July, Biothera was acquired by HiberCell, followed by the acquisition of biotechnology company Stemonix by Cancer Genetics in August. In both cases, the companies announced their intention to keep the acquired companies in Medical Alley. At least 20 acquisitions or mergers were led by Medical Alley healthcare companies, including Makana Therapeutics merging with Recombinetics and Bright Health’s acquisition of California based Brand New Day.

In 2020, Minnesota’s Medical Alley remained a top destination for investment capital. Led by innovative health plans and bolstered by a record high year for the medical device sector, the region shattered records. In 2020, Minnesota’s Medical Alley remained a top destination for investment capital. Led by innovative health plans and bolstered by a record high year for the medical device sector, the region shattered records. We expect 2021 to be yet another record-breaking year for The Global Epicenter of Health Innovation and Care™.