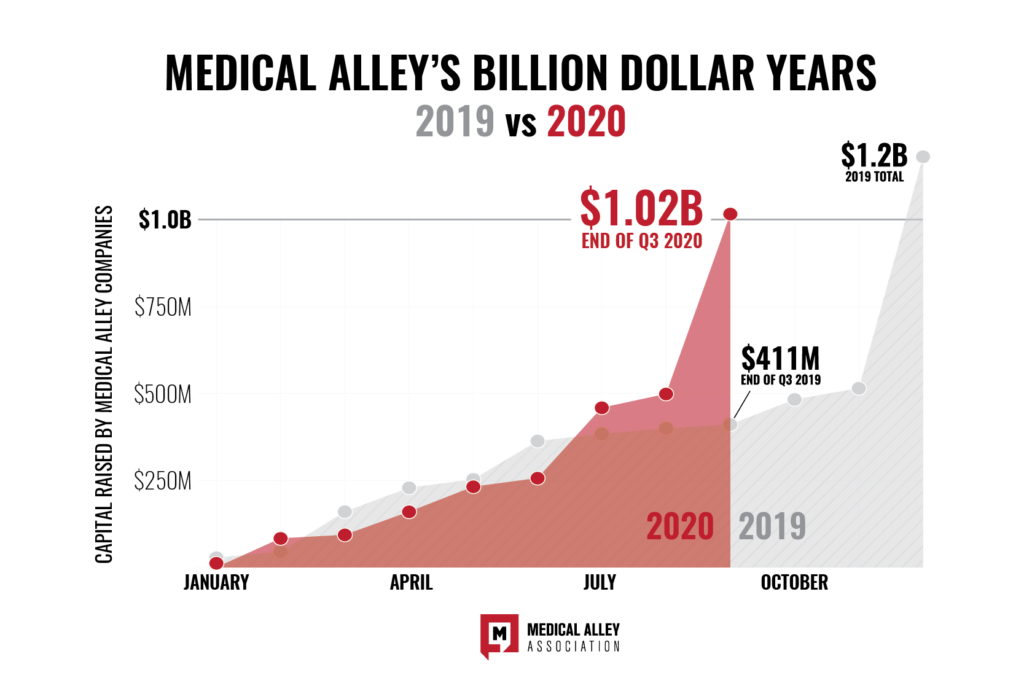

A year after raising over $1 billion in capital for the first time ever, Medical Alley companies accomplished the feat again, this time needing just three quarters to pass the $1 billion mark. Medical Alley was already known as The Global Epicenter of Health Innovation and Care™, but back-to-back years with over $1 billion raised establishes that this region will continue its tremendous growth, built on the world-class foundation established here over the last 50 years.

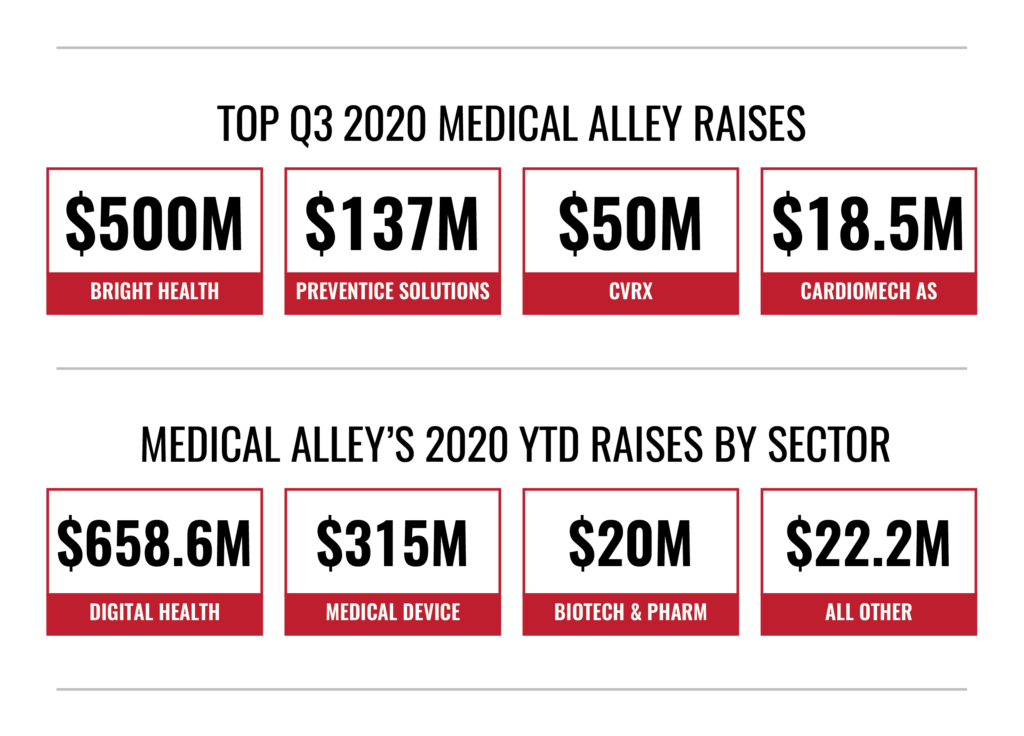

In total, 58 Medical Alley companies have raised $1,015,712,605 so far this year, showing the strength of the early- and growth-stage ecosystem here and proving that 2019’s billion-dollar year was a show of ongoing growth. Digital health currently leads all sectors, having raised more than $658.6 million this year, but medical device companies are drawing substantial interest as well, with $315 million brought in so far this year.

Of the more than $1 billion raised this year, $759.3 million was raised in the third quarter alone, led by Bright Health’s mammoth $500 million Series E raise announced just eight days before the quarter’s end. Even before their exciting announcement, however, Medical Alley companies had already established a new record for funds raised in a third quarter — thanks to raises from Preventice Solutions, CVRx, and CardioMech — and had locked down the second strongest year-to-date in the last 10 years.

While it would be a mistake to overstate the impact of Bright Health’s round, it would be even more unwise to diminish it; after all, it was the second largest venture round taken by a healthcare company in the United States so far in 2020. The company was already backed by top-tier investors like Bessemer Venture Partners, Greenspring Associates, and NEA that have invested in the company in multiple rounds but added best-in-class late-stage investors Blackstone, Tiger Global Management, and T. Rowe Price Associates in this round as well.

Bringing the Future of Healthcare Forward

The second-largest raise of the quarter was by Preventice Solutions, which netted $137 million in its Series B round to advance its AI-enabled remote cardiac monitoring technology. Remote patient monitoring has become an area of increased attention from not only investors, but also payers and providers since the onset of the COVID-19 pandemic, and Preventice’s innovative approach to the concept did more than just pique investors’ curiosity. In September, the company was named remote cardiac monitoring company of the year by Frost & Sullivan Global, validating investor confidence in both Preventice’s technology and its talent.

While Preventice is a strong example of Medical Alley’s appeal to investors in search of not just strong returns, but also companies committed to solving healthcare’s biggest problems, they are far from the only such company that raised money in Medical Alley last quarter. CVRx, which had already received the FDA’s breakthrough designation for their BAROSTIM NEO neuromodulation device for heart failure, brought in $50 million to support the commercialization of the product — the clinical trial for which was so innovative, it is being hailed as a new model for heart failure trials.

As further proof of Medical Alley’s ability to bring the best novel solutions from an initial idea to a finished product that benefits patients, a number of Medical Alley startups, CVRx included, stand to benefit from the recently proposed rule by the Centers for Medicare and Medicaid Studies (CMS). The proposed rule, which would guarantee coverage for devices that reach the market via the FDA’s breakthrough pathway, was announced by CMS Administrator Seema Verma on a trip to Medical Alley, which is fitting given the high concentration of breakthrough devices developed here.

Looking Ahead

A tremendous amount of volatility remains probable for investors as both the race for a COVID-19 vaccine and the upcoming presidential election are likely to cause sizable market movements. As a long-term investment class, venture capital does tend to be insulated from the day-to-day market changes, but prolonged uncertainty can end up affecting the venture community as well. Investment in digital health will likely remain high as investors have reason to believe beneficial policy changes will help the sector sustain the momentum it has rapidly built in 2020.

Looking to 2021 and beyond, Medical Alley is in a phenomenal position to not only maintain its strong growth trajectory, but also to improve on it because of the new lens through which investors are viewing healthcare. Medical Alley’s track record of producing companies that generate solid returns for investors while actually solving the problems they purport to solve means that investors get the double bottom–line benefit of having made money while improving society at the same time.

The world has always needed innovative healthcare solutions, but the need is more acute than ever, and that makes The Global Epicenter of Health Innovation and Care™ a destination for investors both now and going forward. As Joe Kaiser, Director at Mercato Partners, put it: “Medical Alley is home to some of the most innovative companies in healthcare, disrupting the market and making great businesses. We are actively looking for additional opportunities, and you can bet we’ll be looking in Medical Alley.”

Looking for more information on how you can get involved with the Medical Alley startup ecosystem? Contact our VP of Intelligence, Frank Jaskulke, at [email protected]