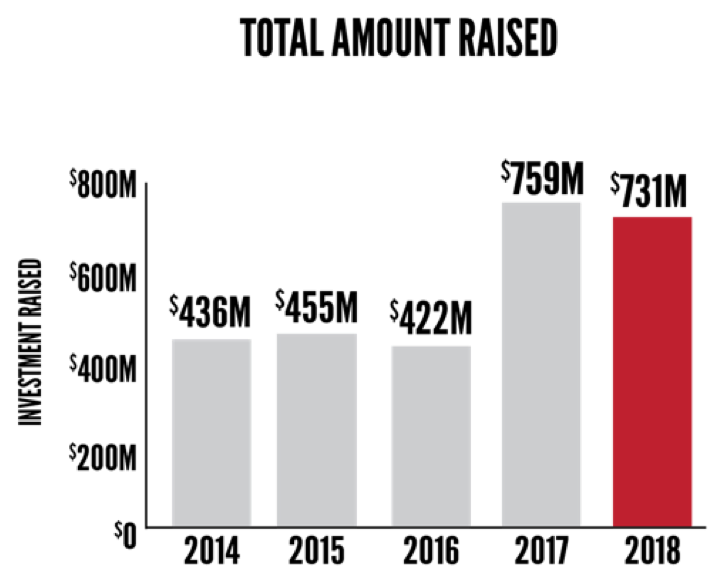

Medical Alley companies have raised more than $2.8 billion over the past 5 years, furthering the region’s reputation as the global epicenter of health innovation and care. For the second year in a row, Medical Alley’s diverse healthcare ecosystem raised more than $700 million across the sectors of medical device, digital health, biotechnology and new care and payment models, and with major exits in each sector.

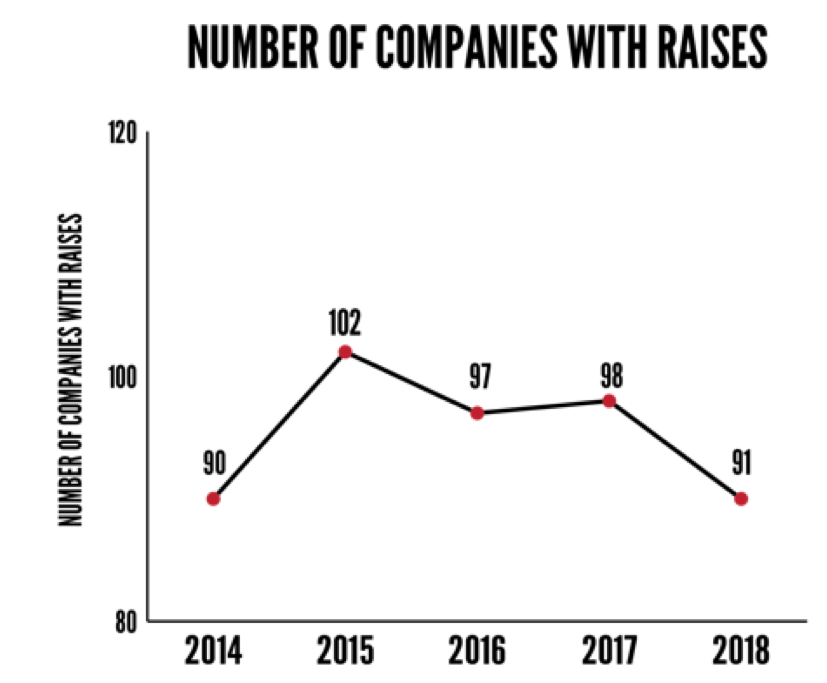

In 2018 $731 million was raised by 91 companies, nearly equaling 2017’s all-time record of $759 million. Bright Health’s $200 million raise led the way and was the largest fundraise in the Midwest according to VentureBeat. Bind’s $70 million and Relievant Medsystem’s $58 million rounded out the top 3. In all, 19 companies raised $10 million or more in 2018.

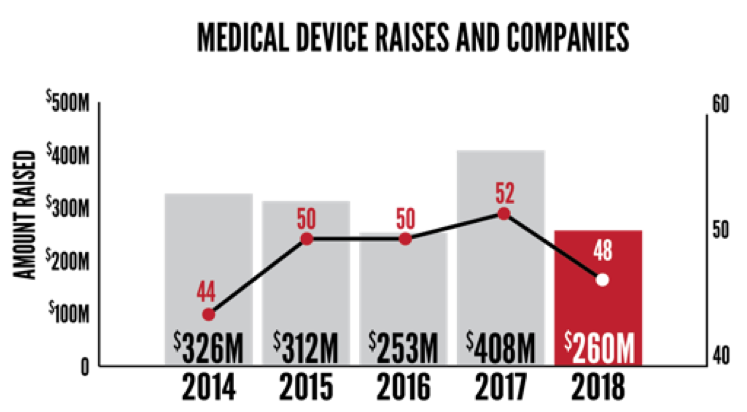

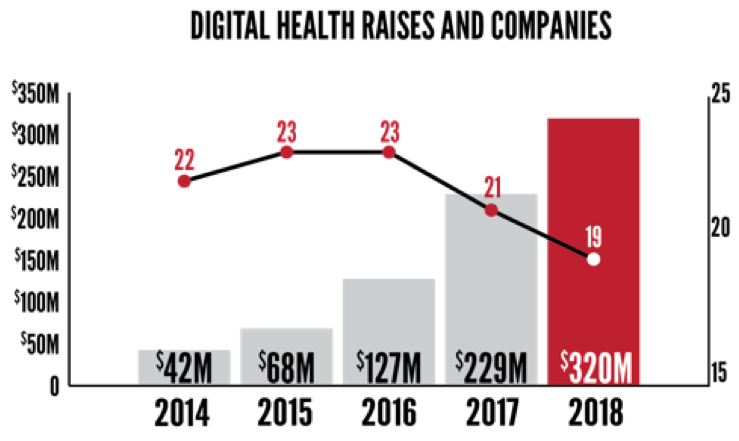

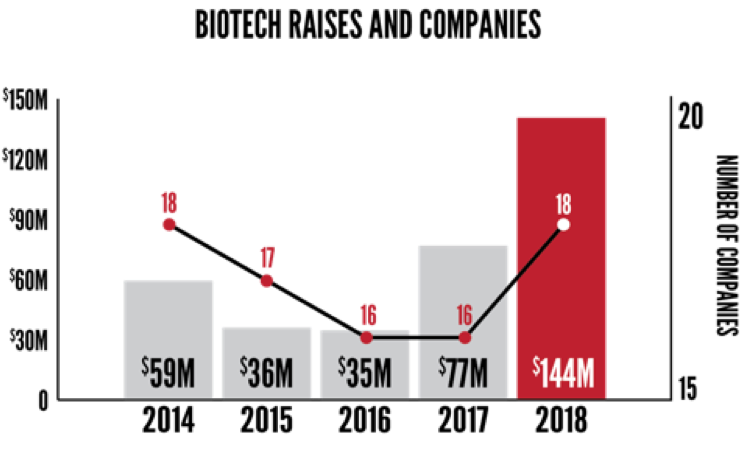

Medical Alley’s position as the leading medical device cluster in the world saw continued growth with $260 million raised by 48 companies, #2 in dollars and #1 in companies for the year. Medical Alley’s digital health community captured the top sector spot in total capital raised with $320 million raised by 19 companies, a 5-year trend of significant increased investment in this sector. Medical Alley’s Biopharma sector set its own record, breaking $100 million for the first time in Medical Alley history with $144 million raised by 18 companies. As healthcare shifts occur and value-based innovative solutions draw larger shares of investment capital, Medical Alley is demonstrating the strength of a diverse healthcare ecosystem that is providing increased investment opportunities across the spectrum of healthcare.

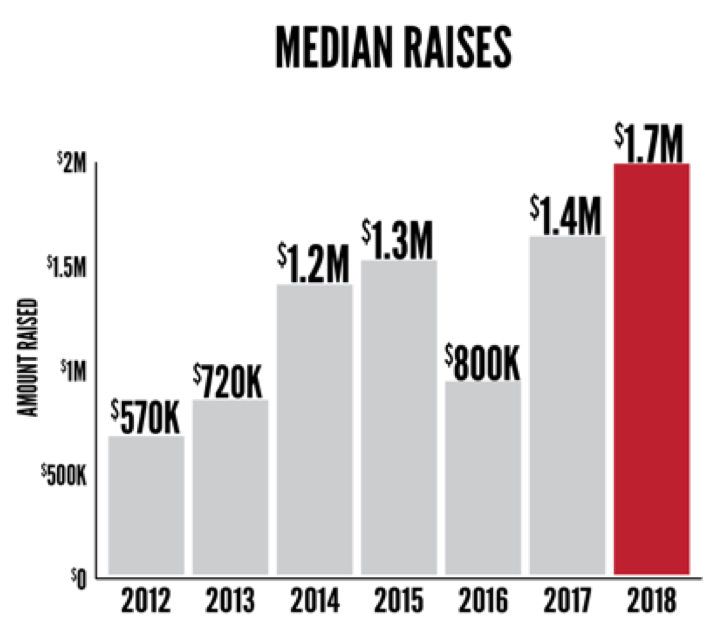

Medical Alley’s median deal size continued to increase for the 3rd year in a row and reflects a broader trend dating to 2012. Since then, median deal size has more than tripled.

2018 Medical Alley activity included a strong showing for exits. Major deals included ABILITY Networks $1.2 billion acquisition by Inovalon, Inspire Medical’s IPO on the NYSE, raising $108 million, the sale of NxThera to Boston Scientific for more than $400 million, and the acquisition of Rebiotix by Ferring Pharmaceuticals. The declared value of exits exceeded $2 billion with millions more in exits where the value was not publicly shared.

As has become common in Medical Alley, post-acquisition activity led to more investment and growth in the region. Shortly after being acquired, ABILITY Networks announced an expansion of its Medical Alley offices and the hiring of more employees. Ferring Pharmaceuticals elected to keep the Rebiotix team in place and invest in Medical Alley as their center for microbiome development. Boston Scientific spun Francis Medical out of the acquisition of NxThera and established it in Medical Alley to leverage the technology platform to move from treating of BPH to cancer.

The story to watch in 2019 will be increasing investments by companies and investors from outside of traditional healthcare and the impacts of broader consumer-focused technologies on the market. Medical Alley-based Best Buy acquired Great Call in 2018, which included Healthsense, a Medical Alley pioneer in using sensor technology and data analytics to detect and prevent health issues.

Over the past 5 years, Medical Alley investment has become a leading indicator of advancements in health technology and significant shifts in the business model changes in healthcare. If you want to see where healthcare is going, follow the money. Medical Alley’s more than 2.8 billion datapoints provides a clear path to an evolved healthcare marketplace with lower costs, improved outcomes and quality, and a very different way of doing business and delivering care.